Charlotte’s real estate market continues to attract investors who see the value in long-term growth and steady rental demand. From single-family homes to multi-unit properties, opportunities are everywhere—but how you finance those deals plays a big role in your returns.

At Showcase Realty, we work with experienced investors and first-time buyers who want to make wise decisions—not just about what to buy, but how to fund it. Here’s a straightforward look at financing strategies to help you secure the right property and build your portfolio.

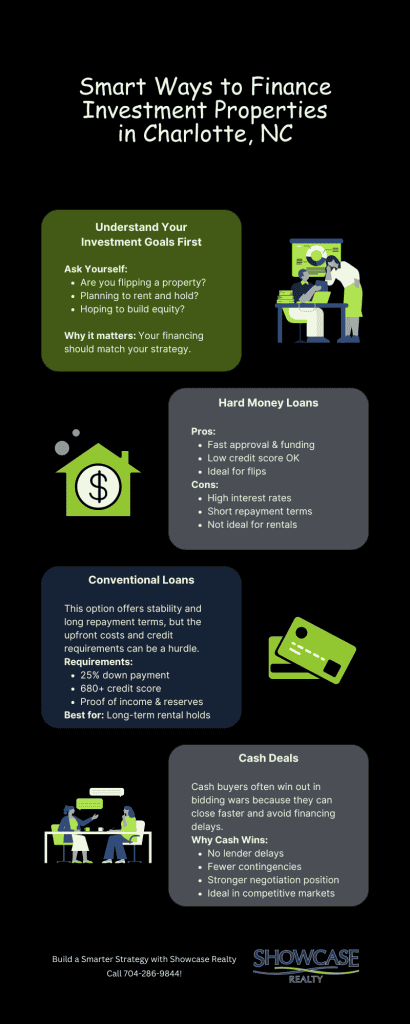

Understanding Your Investment Goals First

Every investment needs a plan. Are you aiming for a quick resale after renovations? Looking to generate monthly rental income? Hoping to build equity over the next few years?

Understanding your approach helps you figure out what kind of financing fits best. Some options are better for flips, others for long-term holds. Once your plan is clear, the money part becomes much easier to figure out.

Hard Money Loans: Great for Flipping, Not So much for Renting

Hard money loans are fast and flexible. They’re popular among flippers who need money quickly and plan to sell the property soon after renovating.

Pros:

- Fast approval and funding

- Easier approval with low credit scores

- Useful for flip projects or short-term needs

Cons:

- High interest rates, often above 10%

- Short repayment windows (6-18 months)

- Not cost-effective for rental properties

If you want to rent out your property long-term, hard money may not be the best fit. The costs can stack up fast and eat into your profits.

Conventional Loans: Reliable but Require Strong Financials

Conventional mortgages are one of the most common ways to finance investment properties, especially for buyers who plan to rent and hold.

What to expect:

- Minimum 25% down payment

- Solid credit (usually 680 or higher)

- Proof of income and financial reserves

This option offers stability and long repayment terms, but the upfront costs and credit requirements can be a hurdle—especially for investors scaling quickly or entering the market for the first time.

Cash Deals Speak Loudest in Competitive Markets

Cash buyers often win out in bidding wars because they can close faster and avoid financing delays. It also signals confidence to the seller, giving you an edge in negotiations.

Why cash works:

- No lender approval delays

- Fewer contingencies

- Stronger position in multiple-offer situations

While it’s not realistic for everyone to buy with cash, those who can often enjoy smoother transactions and better deals.

Build a Smarter Investment Strategy

If you’re thinking about buying an investment property in Charlotte, let’s talk. At Showcase Realty, we’re here to guide you through the Charlotte NC home buying process from start to finish.

We’ll help you:

- Understanding your financing options

- Connect with reliable lenders

- Find the right investment properties

- Build a strategy that matches your goals

Contact Showcase Realty today at 704-286-9844 to get started!