Understanding who approves your loan is crucial in the home-buying process.

Let’s break down the essential stages of loan approval, focusing on the key decision-makers and their roles.

I, Nancy Braun, owner of Showcase Realty in Charlotte, NC, offer insights into this critical process.

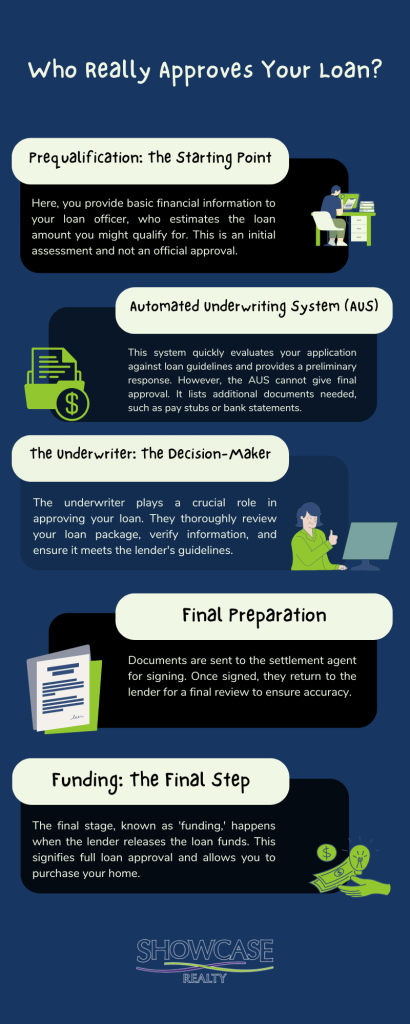

Prequalification: The Starting Point

The first step is prequalification. Here, you provide basic financial information to your loan officer, who estimates the loan amount you might qualify for.

This is an initial assessment and not an official approval.

Automated Underwriting System (AUS)

Your application then moves to the Automated Underwriting System (AUS).

This system quickly evaluates your application against loan guidelines and provides a preliminary response.

However, the AUS cannot give final approval. It lists additional documents needed, such as pay stubs or bank statements.

The Underwriter: The Decision-Maker

The underwriter plays a crucial role in approving your loan. They thoroughly review your loan package, verify information, and ensure it meets the lender’s guidelines.

For example, if you’re self-employed, they’ll scrutinize your profit and loss statements. The underwriter’s approval is critical for moving your loan forward.

Me and my team emphasize, “A skilled underwriter ensures all requirements are met, making the loan approval process smoother.”

Final Preparation

After the underwriter’s approval, your loan enters the final preparation phase. Documents are sent to the settlement agent for signing.

Once signed, they return to the lender for a final review to ensure accuracy.

Funding: The Final Step

The final stage, known as “funding,” happens when the lender releases the loan funds.

This signifies full loan approval and allows you to purchase your home.

Beware of Premature Approvals

My team advises caution with premature approvals. Ensure the approval has passed the underwriter’s review.

Actual approval comes only after a thorough examination by the underwriter.

Knowing who approves your loan helps you understand and navigate the home-buying process more effectively.

The underwriter is the key decision-maker, ensuring all conditions are met before final approval.

With expert guidance from professionals like Nancy Braun at Showcase Realty, you can confidently move through this process.

For more information on buying or selling a home in Charlotte, NC, visit Showcase Realty or contact Nancy Braun at 704-286-9844.