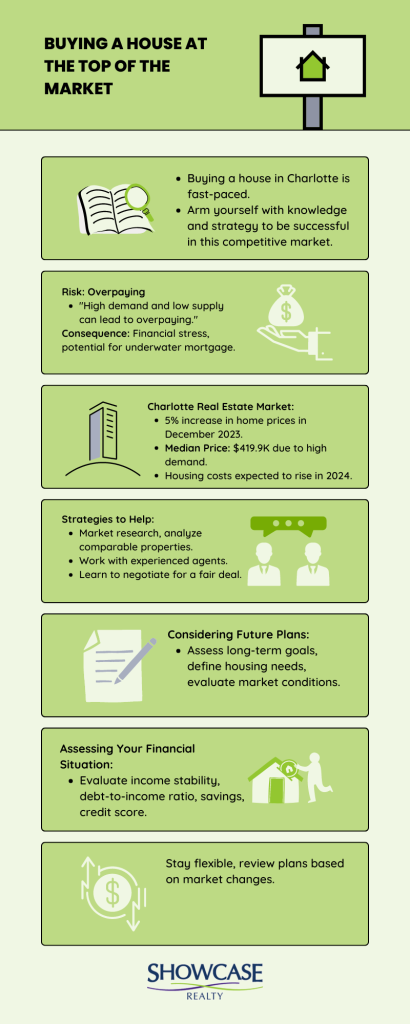

Buying a house in Charlotte is fast-paced. Houses would sometimes vanish from listings in the blink of an eye. But don’t worry! You can still keep up amidst this chaos. But this is only possible if you arm yourself with knowledge and strategy.

We’ll talk about the risks of buying a house at the top of the market in this article. You’ll learn strategies from Nancy Braun of Showcase Realty, a top real estate agent in Charlotte.

What are the Risks of Buying a House in a Seller’s Market?

1. Overpaying

One of the risks of buying in a seller’s market is the potential of overpaying for a property. This happens because of high demand and low supply of homes for sale. As a result, the prices go up, and buyers pay more than the house is worth.

Charlotte Real Estate Market:

According to Realtor.com, the home prices in Charlotte, NC, increased by 5% in December 2023. Houses reached a median price of $419.9K due to high demand.

Experts project that housing costs will keep rising in 2024. This pressures homebuyers to find affordable homes in such a competitive market.

Know the Risks of Overpaying:

- Overpaying for a property can cause financial stress. You might struggle to keep up with mortgage payments and other homeownership expenses.

- If the housing market goes down, the value of your home could drop, too. This means you are at risk of being underwater on your mortgage, and it will be harder to sell or refinance.

Strategies to Help:

Do your research. Conduct market research before buying a house. Analyze comparable properties and visit open houses to understand what prices are fair.

Get expert help. It’s a good idea to work with experienced agents like Nancy Braun, who has an in-depth knowledge of the local market. Her negotiation skills can help you secure the best possible deal.

Negotiate wisely. Learn how to negotiate with sellers to get a fair deal. Don’t be afraid to pass on overpriced properties and look for other options that align with your budget.

2. Considering Future Plans

Considering your future plans is essential when buying a home in a seller’s market. Here’s a simple guide to help you out:

Step 1: Assess your long-term goals

- Start by envisioning your ideal future. Do you have big career plans or plans for your family? These things will determine your ideal location and type of home.

- Decide if you want to stay in the same home forever or if you want to move later on.

Step 2: Define your housing needs

- Make a list of your non-negotiables in a home. Do you need to be close to schools or parks? Do you want a big yard or a modern kitchen?

- Put the most important things at the top of your list.

Step 3: Assess the housing market

- Research current housing market conditions in your target area. Are there lots of homes for sale, or only a few? Are prices going up or down?

- Analyze how these trends may impact your future housing options.

Step 4: Recognize the risks

- Know that buying a home in a seller’s market can be risky. You might end up overpaying for a home or face fluctuations in property values.

- Evaluate how these risks might affect your long-term plans.

Step 5: Decide how long you’ll stay

- If your future housing plans are uncertain, contemplate whether it’s worth buying a home now. You do not want to invest a lot of money if you’re only going to live there for a short time.

- Consider if the home will still be a sound investment if you sell it later.

Step 6: Get Help From Experts

- Consult with realtors like Nancy Braun, who specialize in your desired market area.

- A reputable real estate agent assists you in negotiating favorable terms.

Step 7: Keep reviewing your plans

- Review and adjust your housing plans based on market changes and personal circumstances.

- Stay flexible and change your plans if you need to.

3. Assessing Your Financial Situation

You have to check if you’re financially ready before you take the leap into homeownership.

- Begin by evaluating your monthly income and its stability. Next, tally all your debts, including car payments and credit card balances. Your debt-to-income ratio helps you determine if you can afford a monthly mortgage.

Click here to learn more about how your debt-to-income ratio can impact your ability to secure a mortgage and why it matters in today’s market.

- Determine how much you have saved for a down payment and closing costs. Aiming for a larger down payment to qualify for better loan terms is good.

See if you have emergency savings and other financial reserves. Make sure you have enough savings for unforeseen costs to still buy a house hassle-free.

- Get a copy of your credit report to verify your credit score. A higher score usually means you’ll get lower interest rates on loans.

If your credit score isn’t that great, there are things you can do to improve it. You can clear debts, dispute inaccuracies, and avoid new credit card applications.

Financial experts stress the importance of financial evaluation before buying a house. According to Bankrate, income, debt, and credit score determine your ability to afford a home and secure a mortgage.

Investopedia also emphasized the hidden costs of owning a home, such as property taxes, HOA, and maintenance fees.

Buying a house is a big step in life. Even if prices are high and there’s a lot of competition, buying a home is still a good idea.

However, the decision to buy a home depends on several factors. You need to consider your finances and how comfortable you are with taking risks.

You can seek guidance from Nancy Braun if you need clarification on the timing of your purchase. You can call Nancy Braun at 704-997-3794 for expert assistance.