Mortgage options for veterans and military personnel are limited to a few types. These types include VA loans, which provide a powerful mortgage in today's market. The power behind these special financing vehicles comes from several significant benefits. These benefits are not usually seen in other loan programs.

One of the benefits of a home loan for veterans in Charlotte, NC is it offers lower interest rates. Those with poor or no credit history can also use such a loan. This makes them an ideal option when compared to high-risk lending criteria by banks.

These are just a few ways a VA home loan is better than others. Let's take an even closer look!

Veterans Administration (VA) loans, in many situations, do not need a down payment. #ShowcaseRealty #CharlotteShortSales #ShortSaleAgentsInCharlotteNChttps://t.co/IpQjU43tiE pic.twitter.com/dz9VLAmGP1

— Showcase Realty (@ShowcaseRealty) June 20, 2021

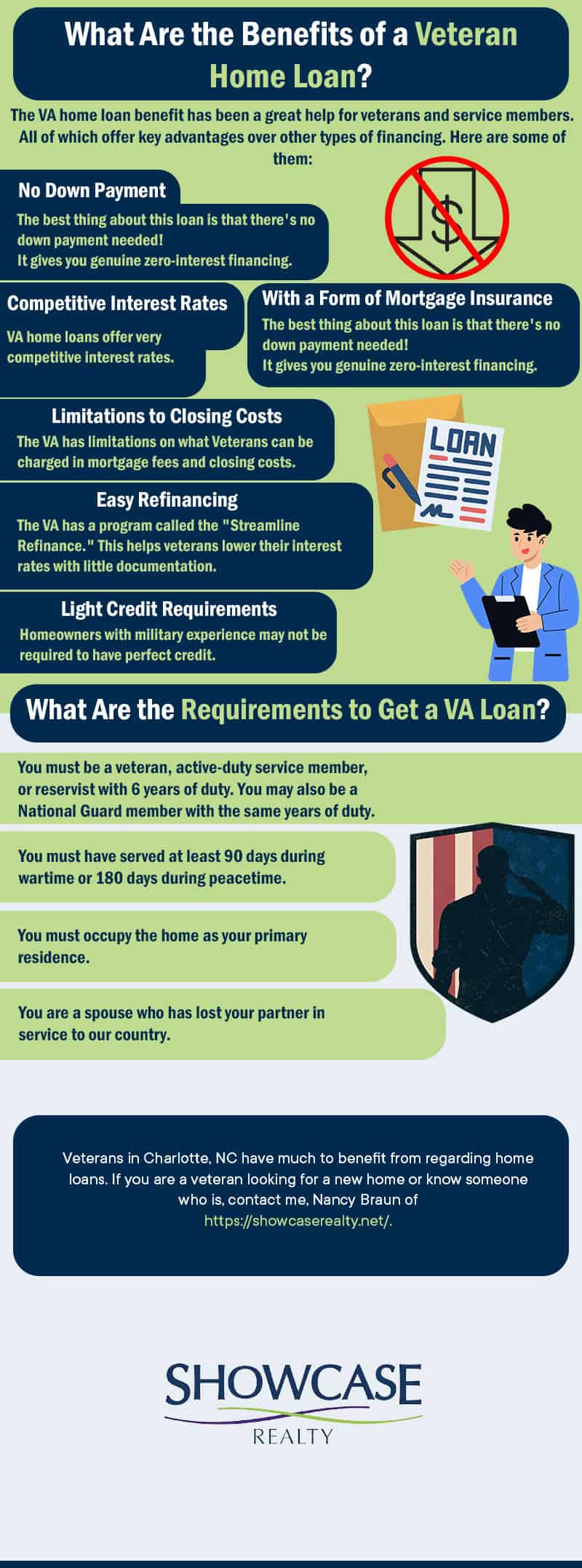

What Are the Benefits of a Veteran Home Loan?

The VA home loan benefit has been a great help for veterans and service members. It has also helped military families achieve the dream of homeownership. This unique mortgage product has several features and benefits. All of which offer key advantages over other types of financing. Here are some of them:

1. No Down Payment

The best thing about this loan is that there's no down payment needed! It gives you genuine zero-interest financing. It also reduces the amount of cash brought to settle at closing. This means you can finance 100% of the home's purchase price without spending money. This can be especially helpful if you have limited cash saved up for a down payment.

It might require a low down payment compared with other types of loans, such as conventional ones. However, the lender will require you to pay an additional fee if your down payment is less than 20%.

You can read more about down payments here.

Do Veterans Get Discounts on Homes?

In addition to the no down payment feature, veterans may be eligible for a VA Funding Fee Discount. The VA Funding Fee is a one-time fee that helps sustain the VA home loan program. This fee can either be included in your loan amount or paid at closing.

2. With a Form of Mortgage Insurance

VA loans come with a funding fee that's rolled into the loan amount. The upfront cost can vary depending on how often this mortgage has been taken out. It ranges from 2% to 3-6%.

The lender is compensated at 25% of the loss if a VA loan goes into default. This rate protects lenders from losses when loans go unpaid or unpaid. It makes it unlikely for them to pursue legal action against you. That's because they'll get more money than what's owed.

In addition, a VA loan requires no monthly mortgage insurance premium. This can save you hundreds of dollars each year.

Do Veterans Get Better Mortgage Rates?

The answer is a resounding yes! VA loan interest rates are generally lower than other types of loans. The Department of Veterans Affairs guarantees a portion of every loan. This guarantee protects lenders from losses if borrowers default on their loans. It makes them more willing to offer lower rates to VA loan applicants.

3. Competitive Interest Rates

VA home loans offer very competitive interest rates. They are often lower than what you would find with a traditional mortgage. The recent removal of a maximum loan amount means you can get more cash with just one month's worth!

4. Limitations to Closing Costs

The VA has limitations on what Veterans can be charged in mortgage fees and closing costs. This is done to make homeownership affordable for qualified homebuyers. Hence, protections are put into place that ensures other parties pay some. This can also ensure parties pay all of these expenses instead.

Are you a veteran looking to buy your home from someone willing to be flexible with the sale price? Ask them about paying any loan-related closing costs that may come up. You could also negotiate for more concessions. Ask for prepaid taxes or insurance coverage if those things interest you.

5. Easy Refinancing

The VA has a program called the "Streamline Refinance." This helps veterans lower their interest rates with little documentation. Frequently, no appraisal is required. If you're looking to reduce your payments or shorten the term of your loan, this could be a great option. Plus, if you're already in a VA loan, there's no need to worry about re-qualifying! The process is much easier than it is for other types of loans.

6. Light Credit Requirements

Homeowners with military experience may not be required to have perfect credit. However, the minimums are typically lower. This makes it easier for veterans returning from war without assets or income. It helps them to get back on their feet financially. However, meeting the guidelines of Charlotte's Department of Veteran Affairs is essential.

VA loans do not have a minimum credit score requirement, but most lenders will want to see a score of 620 or higher. Additionally, they look at your entire financial picture, not just your credit score. So even if your score is lower, you may still be eligible for a loan. Avoid these 9 buyer traps like a pro! https://showcaserealty.net/9-buyer-traps-and-how-to-avoid-them/

How Much Does the VA Loan Cover?

The answer to this question depends on a few different factors. These include the property type, eligibility status, and amount of down payment. The VA loan program generally provides up to 100% financing for eligible veterans. If you qualify, you can buy a home with no money down.

The VA loan program offers fantastic benefits for those who do not qualify for 100% financing.

What's better than a home loan? A guaranteed 50 percent! The Veterans Affairs Department will guarantee up to $45,000 of your mortgage. Plus, you'll avoid paying private mortgage insurance (PMI)! It can save you hundreds of dollars each year.

What Are the Requirements to Get a VA Loan?

To get a VA loan in Charlotte, NC, you'll need to meet one or more of the following requirements:

- You must be a veteran, active-duty service member, or reservist with 6 years of duty. You may also be a National Guard member with the same years of duty.

- You must have served at least 90 days during wartime or 180 days during peacetime.

- You must occupy the home as your primary residence.

- You are a spouse who has lost your partner in service to our country.

What Are the Disadvantages of a VA Loan?

While VA loans have several benefits, there are a few disadvantages to be aware of. These include:

- The home must be for your personal occupancy. You cannot use it as an investment property or vacation home.

- VA loans are more restrictive regarding the type of home you can purchase. For example, you may have difficulty finding a condo that is VA-approved.

- You might be in for a rough ride if you buy without money. Once the VA funding fee is added, your loan amount will likely exceed what's left on the mortgage. So, you'll have less equity.

There might be a few disadvantages. Still, VA loans are an excellent option for eligible veterans and their families. If a VA loan is right for you, contact a qualified lender in Charlotte, NC to get started. Experience endless benefits! fuel your innovation with our visionary support. Click here!

The Bottom Line

Veterans in Charlotte, NC have much to benefit from regarding home loans. If you are a veteran looking for a new home or know someone who is, contact me, Nancy Braun of https://showcaserealty.net/.

I am an expert in securing the best possible mortgage products and rates. With my help, you can find the perfect home in Charlotte, NC. You can also enjoy everything this attractive city offers.